|

|

|||||||

|

Tort or no-fault combo problem |

|||||||

| FTLComm - Tisdale - Friday, January 24, 2003 | |||||||

Winston Churchill |

|||||||

|

|

|||||||

|

what's |

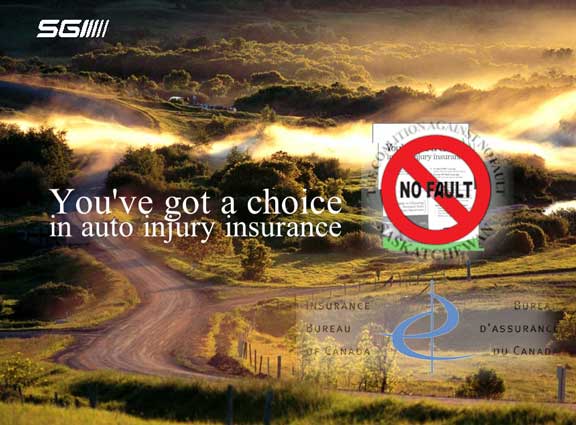

To see the commercials Saskatchewan Government Insurance has been running on television since the beginning of the year one might get the idea that Saskatchewan is heaven in terms of automobile injury insurance. CBC Radio and the local weekly newspapers in Saskatchewan have all pitched in as best they can, to help out the people of the province, to figure out just what is best for them to do with regard to their insurance. | ||||||

|

|

|||||||

|

history |

So, just to sort out the basic issues you really need to get a grasp of the history involved. Saskatchewan Government Insurance was very much following the lead of the Province's premier Roy Romanow. Mr. Romanow came to power after two terms of government by the Progressive Conservatives lead by the cheerful Grant Devine. Devine and his government had a very clear idea of what they wanted as they were driven by their own political beliefs and had mercilessly spent considerably more money that could be raised by taxation in several life times. Faced with massive interest payments on the Devine debt Mr. Romanow took the tough road of attempting to chop every possible form of government spending. He and his ministers were successful but to accomplish such success there were casualties. | ||||||

|

|

|||||||

|

suspicion |

Mr. Romanow discovered that with the cost cutting agenda comes a prevailing attitude of suspicion that there must be people out there who are defrauding the taxpayer. He brought in a whole series of antisocial attitudes into Crown corporations including SaskPower and SaskTel but most of the nastiness came out in the Workers Compensation Board which essential became a Workers uncompensation board. Things were back for anyone who got injured at work and surprisingly enough that concept of screwing the injured gravitated to the government insurance company and in 1995 as part of a simple and direct means of reducing claims the company introduced no-fault insurance. | ||||||

|

|

|||||||

|

unhappy |

It wasn't a good thing. If you were not hurt in an accident you would not be aware of the truly vicious direction insurance in the province took as it followed the nopay, cut-you-off, system developed by the Workers Compensation Board. Bogus treatment programs and straightforward activity that ignored the civil rights of people as those were striped away from injured people and without a legal system to protect them there were a lot of very unhappy and many tortured people in the province. | ||||||

|

|

|||||||

|

graceful |

The pressure from the organised opposition to the no-fault programme mounted and with Romanow's departure and a relaxation in the financial situation the government and the insurance company had to figure a graceful way out of their predicament. After all the hardship that had been done to victims they could not reverse themselves for fear of massive legal claims so the alternative was to continue no-fault but offer a sort of Tort alternative. This brings us to the present where we have people trying to figure out what is the right thing to do because at the back end of the whole thing are the same people. The mean, cruel and dangerous bureaucrats who administered no-fault and all of its secret police methods are still in charge and pretending to smile. | ||||||

|

|

|||||||

|

our |

Ever since this web site began we have ran a series of stories by various people including abused spied on victims and it is very hard to believe that changing uniforms will change attitudes. Among those who have written of their condemnation of the attitude that was at the root of the SS/SGI tactics was Mario deSantis whom I recall after having seen the injured and suffering first hand at a hearing in Prince Albert was shaken to the core. Having grown up in Italy after the war he had seen the results of Fascism and the signs were present and he was really moved by that event. Another contributor who successfully ran the organisation to oppose the no-fault programme was Lorie Terry whom this province owes a debt of gratitude for her valiant efforts against a bunch who used spies, video cameras and there have been suggestions of even more, to further their government and company's true purpose. | ||||||

|

|

|||||||

|

corporate |

On July 13, 2002 Mario deSantis wrote his story Corruption in Corporate (North) America: the sky is truly falling, trust no one. In which he stated: | ||||||

We have guru Jim Rivait , vice-president of the Insurance Bureau of Canada, telling us that the auto-insurance industry cannot afford a Tort system and therefore he strongly supports No Fault Insurance with no regard for the faulty party and with no regard of pain and suffering. But the role of insurance is to satisfy consistently a social need and not to satisfy the interest of the corporate industry. |

|||||||

|

|

|||||||

|

talk to |

Mr. Rivait having seen the above statement wrote the following: | ||||||

We haven't met, and I have never received a call from you, but I have managed to make it on to, at least, one of your websites. It appears you have been misrepresenting me, and if you do some checking, you will find that out. Perhaps you might want to call the president of the Alberta Civil Trial Lawyers Association to hear my position on no-fault insurance. His name is Ron Everard, and I have cc'd him on this email to let him know that you may contact him. Once you hear my position, I would appreciate having any reference to me that is contrary to what you hear from Ron, removed from any and all articles, and or websites. |

|||||||

|

|

|||||||

|

freedom |

It really is good to hear from Mr. Rivait because up to this point no one from Saskatchewan Government Insurance or the Government itself have ever refuted, or defended themselves for their reprehensible behaviour using no-fault as an excuse to cause such hardship to injured accident victims. I hope that Mr. Rivait is not to disappointed, but though he suggests he holds a much different view than that which Mr. deSantis states, Mr. Rivait is on the record for saying that the "auto-insurance industry cannot afford a tort system." It is my job to do the editing on this site and freedom of expression is written in the Charter and its my duty to make sure that divergent views are heard, including those held by Mr. Rivait. Here is what he says his position is: | ||||||

|

I have been a proponent of the tort system and am on record stating as much. |

||||||

|

|

|||||||

|

oppose |

With respect to Saskatchewan, I oppose two systems running concurrently. That will be a huge headache, and as you probably already know, there has been very little uptake of the tort model (around 1000 of 650,000 drivers). Every system in Canada is a blend of fault and no-fault, with the exception of Quebec. |

||||||

|

|

|

||||||

|

advocate |

Even the no-fault system in Saskatchewan, allows lawsuits to recover any economic loss sustained, and to even recover pain and suffering awards from a drunk driver, if I recall correctly. We have a tort system in Alberta, which we prefer - and have publicly stated that. In fact, IBC (Insurance Bureau of Canada) has always taken the position that the benefits of tort reform far outweigh any movement to a no-fault system. |

||||||

|

|

|

||||||

|

Saskatchewan |

In Saskatchewan, we believe that there should be one system or the other. As far as it goes, results in Saskatchewan haven't been too bad, so why change? As well, it is very difficult for the average insurance consumer to select the product that works best for them. Remember, the choice isn't just between tort and no-fault, it is between the tort compensation package as presented versus a very generous no-fault package. |

||||||

|

|

|

||||||

|

a few |

Icertainly do not support raising the benefits under no-fault to $5 million from $500,000 for the sake of a dozen or so that have gone, or will go, beyond the $500,000 limit. Nor do I support causing huge uncertainty by offering two complicated systems, that has caused a number of companies to stop writing extension auto, for the sake of a thousand people. |

||||||

|

|

|

||||||

|

SGI |

The government wanted to increase choice, but they effectively reduced choice as there are less private insurers to choose from. If the Saskatchewan wanted to truly provide choice, they would get rid of the SGI monopoly and allow private insurers into the market. |

||||||

|

|

|||||||

|

comments |

I think Mr. Rivait has made his position clear and appreciate getting this from him. I would also welcome comment or his position on issues in the future. Now Mario deSantis is an economist and I am a former school administrator and psychologist so we are hardly equipped to comment on the points Mr. Rivait makes here. So we went to Saskatchewan's own people's insurance advocate Lorie Terry and here is what she had to say: | ||||||

|

Jim's first statement that every province is a blend is somewhat misleading in that yes most insurance provides a no-fault base, which Saskatchewan had pre 1995. This was to insure that an at fault driver would receive benefits if injured. However Saskatchewan, Quebec, and Manitoba were pure no-fault provinces. |

||||||

|

|

|||||||

|

500 news |

We agree with Jim that choice is going to be a headache but as you know the Government was very unpopular for the way it was treating no-fault victims and we have over 500 news articles to show it. |

||||||

|

|

|||||||

|

opt out |

The Government has instituted the choice system in a negative opt out model with little or no education of the public as to what the two systems stand for, and therefore most will stick with no-fault as the numbers look more impressive, and it requires an individual to go down to a broker to change it. Promotion of the tort aspect has been minimal and misleading at best. The population in general have no understanding of the rights lost and oppression they will fall under until the time of an accident. |

||||||

|

|

|||||||

|

only those |

Jim is wrong in his understanding of economic loss. Only income earners of over 58,000 are entitled to sue for economic losses and for those who do not earn this amount will only receive 90 percent of their net income. This can be devastating for small business owners and farmers who pay the majority of their bills with their gross income. For seven years drunk drivers could not be sued if they hurt or killed someone in the province of Sask. This changed on July 4, 2002. |

||||||

|

|

|||||||

|

work |

With no informed consent because of liability reasons most consumers are making decisions that may not be the best for them and may in fact hurt them should they be injured. We believe if the Government is going to keep Choice they should let the victim choose at the time of injury, which system best compensates them and what no-fault will require of them. For example 8 hours a day 5 days a week of work hardening programs lifting pails of cement and shoveling gravel. |

||||||

|

|

|||||||

|

adjusters still |

It would not matter if the Gov changed the rehab amounts to 23 million dollars, the adjuster is in total control of these monies, I am fighting for a paraplegic to have a bike that will work his upper body. It is just a number to add to the confusion. |

||||||

|

|

|||||||

|

mistreated |

Let us also remember the many studies that SGI has performed on us with no informed consent that CBC TV has documented in two documentaries. no-fault is so powerful that you can be experimented on like a guinea pig with no ability to say no. |

||||||

|

|

|||||||

|

has SGI |

We have as kids, as adults and mature people, learned that the statements and advertising that a company or government may do are only hallow words without the action and honourable acts that illustrate their real committment to an issue. If you did not read Lorie's comments or mine at the top of this page, you could still make an informed decision about your insurance choice. Ask your self this, under no-fault did the government owned and operated insurance company fairly and honourably treat the victims of motor vehicle accidents? If you answer yes to that question don't do anything and continue under no-fault as you have no need for a lawyer if you are involved in an injury producing accident. If, on the other hand, you determine that the insurance company did not act fairly and honourably, then opt for the tort system which will allow you to seek a legal remedy if you are injured in an accident. | ||||||

|

|

|||||||

|

|

|||||||