|

|

|

|

Dollarization and Terence Corcoran: |

|

| Nipawin - Tuesday, January 22, 2002 - by: Mario deSantis | |

|

speed |

It is a fact that we have a conventional productive capacity far in excess of what we can sell. It is another fact that we have a disconnect between the satisfaction of needs and the satisfaction of wants, and it is another fact that money moves around at the speed of light to look for the highest return on 'investments.' |

|

|

|

|

geopolitics |

It is another fact that while President George Bush Jr. states that Free Trade creates jobs for American workers we know that his foreign policies based on geopolitics will maintain the balance of power all over the world, a balance of power where the United States is the sole super power. |

|

|

|

|

casino |

It is another fact that a Free Market based on making money with money has led us to an oligopolistic gambling casino where the statistical experts make decisions and predict our future. |

|

|

|

|

more on |

Some time ago I ventured to say that the Free Market is supported by the military power of the United States and that therefore we make peace by waging wars. It is natural to understand that as long as resources are allocated more in the arms industry so more chances to wage wars around the world are created. Just think that the war in Afghanistan could cost in the order of some US$ 750-million per month excluding the social costs of killed civilians, of destroyed properties, of broken families, of a population in disarray. Just think that the rebuilding of Afghanistan could be in the order of US$15-billion over a ten year period. More money will be spent in destroying people and properties than on rebuilding these same countries! |

|

|

|

|

learn |

We must change the way we are thinking, and above all we must learn how to become citizens and construct our own realities. |

|

|

|

|

copy |

When I was teaching in Weyburn, Saskatchewan, in the late 80's, I had college students who expected me to transfer my knowledge to them by dictating notes! Later, I realized that this problem of copycatting and of transfering knowledge rather than being intelligent and learning is not only widespread in our society, but it is institutionalized. Just think how inventive we have become whenever we make money through technological innovations protected by copyrights for some twenty years. |

|

|

|

|

self |

Timothy Shire, publisher of Ensign, has just recently described how our educational system has been hijacked by the Chambers of Commerce. This morning I breath some fresh air as I happened to visit the web site 'Institute for Local Self-Reliance' and I read that we need new rules that honor a sense of place and prize rootedness, continuity and stability as well as innovation and enterprise. |

|

|

|

|

Investment |

Let me say some thing about the investment myth. We don't have productive investments when we invest in the stock market. Whenever in the 90's we invested in the stock market we created a Big Bubble as the share price to earnings ratios has gone from a traditional ratio of 15/1 to the current 30/1. Whenever we invest into the stock market we don't create productive investments. Productive investments are those providing a sense of social cohesiveness and continual social growth for families, for local communities, and for the country. |

|

|

|

|

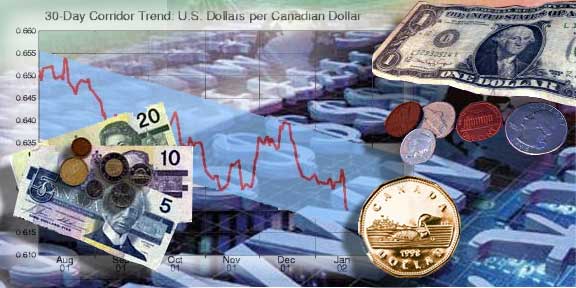

dollarization |

Let me also say something else about dollarization, that is the replacement of local currency by the American dollar. We in Canada have been talking about dollarization for sometime now and this has become a hot topic among economists, bankers, businesses and politicians. All of these Big Brains talk about the pros and cons of dollarization for Canada and they have no clue of what is happening to people around the world, or at least they don't want to know about it. |

|

|

|

|

not |

The dollarization for Canada is not the same as having the EURO in Europe where countries got together and decided to go for a common new currency and common economic policies. The dollarization for Canada would mean to exchange our Canadian dollar for the American dollar and be subjected to the economic policies of the United States. There is nothing wrong with the dollarization of Canada, but what is important is to realize what it means to all Canadians and not only to experts, to bankers, to businesses or to politicians. |

|

strong |

|

|

|

|

|

all wet |

Concorn is all wet as he equates a strong dollar with a strong country, while he doesn't know what makes a country strong. A country is strong when its people are strong, when its people are happy, when its people are at peace within themselves and with their neighbours. What does Concoran know about the American dollar? Is the American dollar strong? And why is the American dollar strong? |

|

|

|

|

Peso |

While everybody is worrying about the slide of the Canadian dollar, we have what appear to be good news. Argentina is devaluing the peso and getting away from the American dollar. We have to remember that the peso was pegged to the American dollar and this was one of the causes of Argentina's economic problems. The delinking between the American dollar and the Argentina's economic needs has been highlighted by the intelligent move of common people to go back to bartering. |

|

|

|

|

lower |

Everybody has been hailing the good years of the 90's without realizing that these good years were the seeds for the current economic downturn. In November 2001, economist Robert Solomon stated |

"What would have seemed very strange to international economists 25 years ago is that the U.S. dollar rose in value while the U.S. balance of payments deficit increased markedly... This raises the question, given the large current-account deficit, whether an effort should be made to lower the dollar's exchange rate." |

|

|

|

|

|

cannot |

In January 1999 financier George Soros was saying |

"Today, American consumers ... are spending more than they are earning ... this is a wonderful world but it cannot last for ever." |

|

|

|

|

|

sharp |

While economist Dean Baker is maintaining that the best economic stimulus for the United States and the world economy would be for the United States to devalue the dollar. Dean Baker says that |

"the strong dollar is leading to large and unsustainable trade deficits. At some point, it will have to fall. This will lead to a substantial reduction in the trade deficit, since a lower dollar makes U.S. goods more competitive, both domestically and internationally... Since current account deficits of 4.5 percent of GDP (the present level) are not sustainable, it is certain that the dollar will fall, but just as with the stock market bubble, the actual timing of the decline is unpredictable. At this point, a sharp decline in the dollar may be the economy's best prospect for renewed growth, in the absence of government stimulus." |

|

|

|

|

|

Bush |

But the Bush's United States is a super power, and rather than devalue its dollar it is sustaining the currency by waging tax cuts at home, by waging wars abroad and by preaching dollarization policies for other countries. |

| Wake up Mr. Concoran! | |

| -----------------References: | |

| War may be costing U.S. $500M-$1B per month, by Calvin Woodward, Associated Press Writer, 11-12-2001 http://www.southend.wayne.edu/days/11122001/news/war/war.html | |

|

|

|

|

|

Institute for Local Self-Reliance http://www.newrules.org |

| STOCK RETURNS FOR DUMMIES, by Dean Baker, December 7, 2001 http://www.cepr.net/stock%20market/stock_returns_for_dummies.htm | |

| Canada's dollar sleeps alone, Terence Corcoran, January 18, 2002 National Post http://www.nationalpost.com/home/story.html?f=/stories/20020118/1167186.html | |

| It's smarter to barter for filling the larder, Argentines learning, by Heather Scoffield, January 21, 2002 — Page A1, The Globe and Mail | |

| Europe, Presented by Robert Solomon, PhD, Guest Scholor, The Brookings Institute, November 5, 2001 http://www.interdependence.org/media/Solomon2.htm | |

| Soros: Share crisis looms, BBC News, January 22, 1999 http://news.bbc.co.uk/hi/english/business/the_economy/newsid_260000/260473.stm | |

| The New Economy Recession: Economic Scorecard 2001, by Dean Baker, December 20, 2001 http://www.cepr.net/new_economy_recession.htm | |

| Weak loonie not our fault: Martin. Liberals blame 'perception problem' in market as dollar languishes near US62¢: Government losing its tolerance for weak currency. Jacqueline Thorpe, National Post January 22, 2002 http://www.nationalpost.com/home/story.html?f=/stories/20020122/1202608.html | |