|

|

|

|

The Biggest BUBBLE of the Free Market: |

|

| Nipawin - Saturday, January 26, 2002 - by: Mario deSantis | |

|

|

|

|

|

|

|

|

|

|

don't |

Everybody is bushing our economic understanding, and the corporate media keeps trumpeting the voice of the Bush administration while more economic BUBBLES are being created by the supreme leaders of the Free Market. We hear about the good times of the 90ies, we hear about today's economic recession, and we hear how forceful leaders are going to take us away from the recession and enjoy again the good times of the 90ies. Again, let me say, don't trust the media, don't trust the politicians, and don't trust me either; just think for yourself and trust yourself. |

|

|

|

|

recession |

My story today is again about the Free Market as this gospel of the Free Market has brainwashed too many people and converted them to useless assets. My message is that ther good economic times of the 90ies was a myth trumpeted by concentrated corporate media, a myth created by neoliberal / neoclassical economists, politicians, big corporations, corporatists, and Free Market converts among us. Today's economic recession is not separated from the supposed boom of the 90ies, as this boom was really a BUBBLE which has bursted and resulted in the current recession. |

|

|

|

|

30 / 1 |

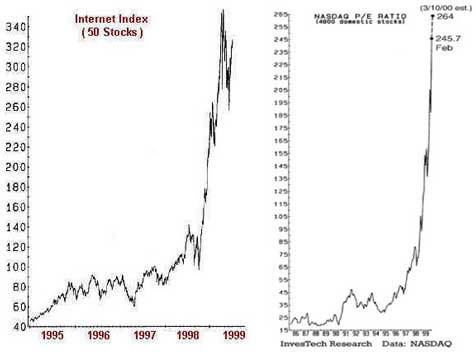

Economist Dean Baker pointed out in November 2000 that the ratio of stock prices to corporate earnings peaked earlier in year 2000 at more than thirty to one, that is more than twice the historic average of about 14.5 to 1 over the last fifty years. Now think of Amazon.com, a corporation which for the first time since its birth eight years ago has posted a profit in the last quarter of year 2001! |

|

|

|

|

spending |

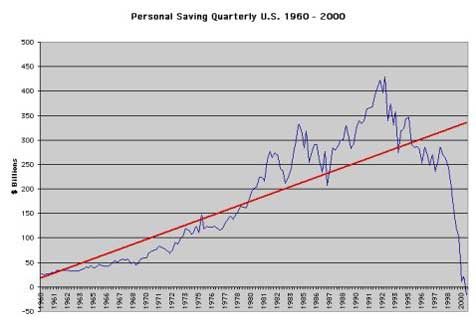

In an economic article dated January 22, 1999 by the BBC News, financier George Soros was quoted as saying that there is a growing BUBBLE due to an exodus of capital out of crisis-hit emerging markets such as Asia, Russia and Latin America (including Argentina). Also, at that time, Soros stated that the historically low interest rates has caused American consumers to be spending more than they have been earning and that this wonderful world wouldn't last for ever. |

|

|

|

|

mergers |

In a 1999 economic article on the possible bursting of the BUBBLE, economist George Reisman was saying that the rise in the stock market in the last few years was not the result of any increase in the ability to save and accumulate capital, and in fact he stated that personal savings have been declining to become negative in the Spring of 1999. Reisman states that this rise of the stock market was further inflated by the continuous mergers of big corporations. These big corporations have been telling us that they have been merging to become more efficient and pass the savings to the consumers while in reality they have been sustaining the BIG BUBBLE with their buying of other big corporations with the so called leverage buyouts, that is the purchase of other corporations with some 70% of borrowed money! |

|

|

|

|

corporations |

So this BIG BUBBLE has been caused by the continuous speculative and greedy motives of our free marketeers and we all know now why the Enron Corporation has collapsed causing the loss of retirement savings and personal lives. Not only big corporations have been co-responsible for the building of the BIG BUBBLE, but they have taken over governments as these governments have become their corporate voices, and they improved the Free Market to become their oligopolistic market, and they have further consolidated their power as they have subjugated common people at large all over the world. |

|

|

|

|

common |

I must say that governments must not be the spokespersons for corporations, I must say that governments must be the servants of common people. |

|

|

|

|

overvalued |

The story of the BIG BUBBLE is not finished yet with this recession as economist Lacy Hunt has stated as recently as last November 2001 that the value of all corporate stocks amounted to about 110 percent of the nation's Gross Domestic Product (GDP) while the usual amount should be about 65 percent. On a $10 trillion GDP this overvalued stock market translates with another BUBBLE in the order of $4.5 trillion. |

|

|

|

|

war |

What do our governments do about this social and economic crisis? They go to war against terrorism, in the name of patriotism, and in the name of the Free Market. |

| -----------------References: | |

| Quote by Donella Meadows "challenging a paradigm is not a part-time job. It is not sufficient to make your point once and then blame the world for not getting it. The world has a vested interest in, a commitment to, not getting it. The point has to be made patiently and repeatedly, day after day after day" ftp://sysdyn.mit.edu/ftp/sdep/Roadmaps/RM1/D-4143-1.pdf http://iisd1.iisd.ca/pcdf/meadows/default.htm | |

|

|

|

| Pertinent article in Ensign | |

|

|

|

| Edward S. Herman page, http://www.thirdworldtraveler.com/Herman%20/Edward_Herman.html | |

| A Collection of the views, ideals, life and legacy of Mahatma Gandhi in multiple media, http://www.kamat.com/mmgandhi/gandhi.htm | |

| The Costs of the Stock Market Bubble, By Dean Baker, November 27, 2000 http://www.cepr.net/stock_market_bubble.htm | |

| Soros: Share crisis looms, BBC News, January 22, 1999 http://news.bbc.co.uk/hi/english/business/the_economy/newsid_260000/260473.stm | |

| When Will the Bubble Burst?, by George Reisman http://www.capitalism.net/articles/stockmkt.htm | |

| Why stock market bubble may continue to deflate, By David R. Francis | Staff writer of The Christian Science Monitor, November 05, 2001 edition http://www.csmonitor.com/2001/1105/p21s1-wmpi.html | |