|

|

| |

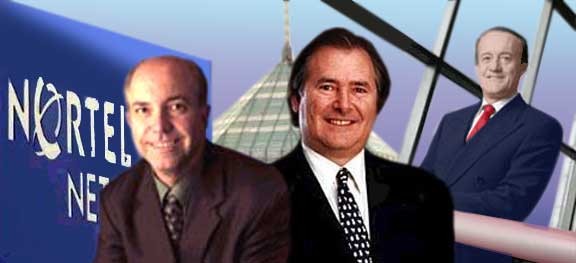

Inside traders:

Terry Hungle of Nortel, Gary Winnick of Global Crossing and Michael Cowpland of Corel

|

| |

|

|

Leaders hide themselves behind the facade of

the BIG LIE:

the Free Market

Defrauding Bubbles, Bankruptcies, Mega Mergers, Efficiencies, Innovations, Productivity

|

| |

|

| Nipawin - Wednesday, February 13, 2002 - by: Mario deSantis |

|

carnival

barker

|

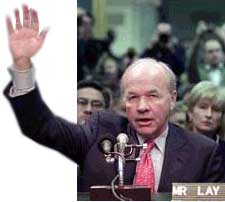

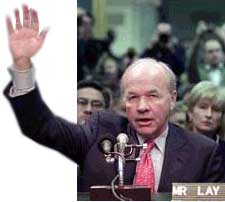

"You're perhaps the most accomplished confidence man since Charles Ponzi. I'd

say you were a carnival barker, except that wouldn't be fair to carnival barkers."

Senator Peter G. Fitzgerald,

as Kenneth L. Lay, former chairman of Enron, invokes the 5th amendment

|

|

$1 billion

a day

inflow

|

In his article The Betrayal of Capitalism, Felix G. Rohatyn writes:

"As of the end of 2001 about 15 percent of all shares

listed on the New York Stock Exchange and the NASDAQ were foreign-owned. They had

a value of approximately $2 trillion. We must keep in mind that we require about

$1 billion per day of capital inflows to finance our trade deficit."

|

|

peso

|

- What does Rohatyn mean?

- It means so many different things to so many different

people, but for me it means that capital inflows (for instance from Argentina) into

the U.S. go to further inflate stock prices; it means sustaining the U.S. economy

while consumer savings are down and foreign trade deficits are chronic; it means

the overvaluing of the American dollar and to devaluing of foreign currencies (for

instance Argentina's peso); it means sustaining the U.S. economy while undermining

other countries' economy (for instance Argentina).

|

|

|

|

|

accounting

bankruptcies

and

mergers

|

- How integral is the North American financial market?

- Big companies use subsidiaries to inflate revenues

and hide debts; big companies inflate their profits by not using General Accepted

Accounting Principles (GAAP); investment firms and Wall Street traders tacitly (as

per Adam Smith's understanding) collude with banks to deterministically and progressively

inflate stock prices while senior executives and traders rob shareholders at large;

after robbing the public at large senior executives and financial gurus either have

their big companies go bankrupt or they arrange for ever bigger mega mergers for

the sake of improving efficiency into the economic system. All this robbing occurs

under the Gospel of the Free Market, under the claim that the so called increases

in productivity is raising the standard of living of people at large, under the claim

that we have to save our freedom by waging a never ending war against terrorism.

|

| |

|

|

|

|

|

quality

of life

declining

|

Economist Dean Baker and Mark Weisbrot

were right in publically recognizing the bubbles of the economic system and stating

that the average American workers experienced a wage increase of 0.5 percent a year

in the last 10 years. In the meantime, we have Minister of Industry Allan Rock

saying

"Our quality of life has been declining

over the past 20 years in comparison with the United States. That's something we

have to reverse."

The ignorance and negligence of present leaders is mind

boggling!

|

| |

|

| |

|

| |

|

|

inside

trading

rampant

|

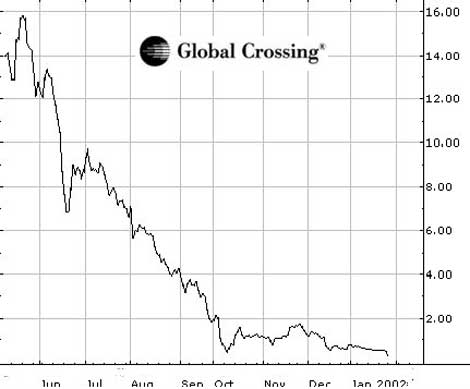

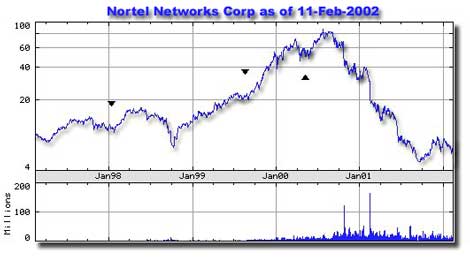

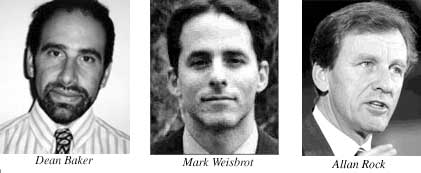

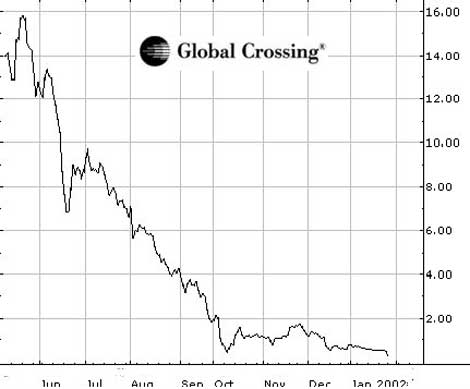

Today I learn that Gary Winnick founded Global

Crossing in 1997, took it public the next year and sold shares worth $734 million

before the company collapsed. Today I learn that Michael Cowpland, founder

of Corel Corporation, has been found guilty of insider training. Today I learn

that Terry Hungle of Nortel is stepping down in the latest insider

trading scandal. |

| |

|

| |

|

|

crisis

|

We have a social and economic crisis all over the world,

yet leaders hide themselves behind the BIG LIE of the Free Market. |

| |

|

| -----------------References: |

| |

Pertinent articles in Ensign |

| |

|

| |

The Betrayal of Capitalism,

by Felix G. Rohatyn |

| |

|

| |

The Bubble That

Wasn't SEC Probe Exposes Investment Banks' Dirty Dealings During Boom Times,

Gregg Wirth |

| |

|

| |

"New Economy"

Cycle Ends, But Myth Persists, by Dean Baker and Mark Weisbrot, November

27, 2001. "Wage growth [between 1991 and 2001] for a typical worker was a paltry

0.5 percent a year" |

| |

|

| |

Rock unveils skills

and innovation blueprint, CBC Canada, February 12, 2002 |

| |

|

| |

How

Executives Prospered as Global Crossing Collapsed, By GERALDINE FABRIKANT

with SIMON ROMERO, New York Times, February 11, 2002 |

| |

|

| |

OSC nixes settlement

with Cowpland, CBC Canada, February 12, 2002 |

| |

|

| |

Nortel CFO quits;

faces regulatory scrutiny, CBC Canada, February 12, 2002 |