|

|

|

Common Sense versus the Sophistication of

Business and Economics: |

|

| Nipawin - Thursday, July 18, 2002 - by: Mario deSantis | |

|

|

|

|

|

|

|

corrupt |

I have always been leery and perturbed about the sophisticated business gurus telling |

| us how to think and do. I was working in the late seventies and early eighties 'under' the | |

| Saskatchewan Health-Care Association (today's Saskatchewan Association of Health | |

| Organizations) and realizing that their pension computer system was a corrupt word | |

| processing system rather than a processing pension system. | |

|

|

|

|

too |

I asked why so much information requested on input forms was not entered (and not |

| processed) into the pension computer system. I was told that the pension computer | |

| system was too sophisticated for me to understand. Guess what, these same | |

| business gurus further enhanced the sophistication of their computer systems with | |

| the assistance of the big businesses SAP and SAIC and in the process, these same | |

| two businesses contributed to the sapping and sacking of Saskatchewan.(2) | |

|

|

|

|

common |

We must remember that what we need is intelligent common sense and not the |

| artificially, fragmented and sophisticated mind set of business and economic gurus. | |

|

|

|

|

money |

Kevin Phillips, author of the book "Wealth and Democracy: A Political History of the |

| American Rich", writes today in the New York Times | |

"the United States economy has been transformed |

|

through what I call financialization. The |

|

processes of money movement, securities |

|

management, corporate reorganization, |

|

securitization of assets, derivatives trading |

|

and other forms of financial packaging are |

|

steadily replacing the act of making, growing |

|

and transporting things."(3) |

|

|

real |

What Kevin Phillips says is that our social and economic system has become too |

| sophisticated and that it suffers from a disconnection of what is really needed as | |

| creation of wealth; in practice, we don't create wealth simply by playing in the stock | |

| market and we don't necessarily create wealth by playing with money either. | |

|

unduly |

Phillips reminds us that economics is basically the act of making, growing and |

| transporting things; and economics is not the rationality brought into the Free Market | |

| as implied by Alan Greenspan's well noted expression | |

"But how do we know when irrational exuberance |

|

has unduly escalated asset values, which then |

|

become subject to unexpected and prolonged |

|

contractions as they have in Japan over the past |

|

decade?"(4) |

|

|

they |

Few days ago I wrote an article and I criticized the relentless message of |

"our business gurus telling us how to learn to |

|

live with ambiguities while these same gurus |

|

along with their corporate and political friends |

|

would make the tough decisions at the right time |

|

and at the right place and at the right price, |

|

and in a cyclical and inconsistent never ending |

|

fashion."(5) |

|

|

coping |

So, the bottom line for ordinary people is to learn how to live with ambiguities while |

| the gurus and their patrician friends do our thinking for us and dictate their inconsistent | |

| and sophisticated economics. | |

|

gurus |

It was while navigating the Internet that I found the best description for our inconsistent |

| and sophisticated economics science, that is "on the other hand economics." It is | |

| really a laugh listening to the gurus and understand that they speak a lot and mean | |

| nothing. So, as you listen to the business gurus don't feel overpowered by their | |

| sophisticated speeches as their bubbling is no different from the bursting bubbles of | |

| the stock market. | |

|

trade |

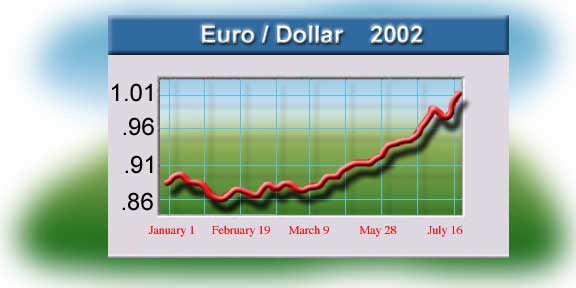

Lately, the Euro currency has overcome the U.S. Dollar and the following are two |

| examples on how "on the other hand economics" explains this phenomenon: | |

i)American manufacturers are happy to see a weaker dollar as they can |

|

sell more of their goods abroad,(6) |

|

ii)on the other hand, Secretary Treasurer John O'Neill wants a stronger |

|

dollar so that more foreign investments can subsidize the U.S. |

|

economy.(7) |

|

|

USA |

We don't need a strong or a weaker U.S. dollar. What we need is just intelligent |

| common sense. Is it right to have a strong U.S. dollar and rape the resources of | |

| other weaker countries while the American economy continues to maintain a chronic | |

| foreign trade deficit and while the American economy requires $1.1 billion of overseas | |

| cash each day to finance its $400 billion deficit?(7) | |

|

devalue |

Non conformist economist Dean Baker expressed his intelligent common sense two |

| years ago as he suggested that a lowered value of the dollar | |

i)would check the bubbles of the stock market, |

|

ii)would reduce the foreign trade deficit, and |

|

iii)would in the end |

|

| provide better growth and stability to our global economy.(8) | |

| References: | |

| Testimony of Chairman Alan Greenspan Federal Reserve Board's semiannual monetary policy report to the Congress Before the Committee on Banking, Housing, and Urban Affairs, U.S. Senate, July 16, 2002 http://www.federalreserve.gov/boarddocs/hh/2002/July/testimony.htm | |

| Fraudulent SGI and the Sapping, Sacking and Downsizing of Saskatchewan By Mario deSantis, June 25, 2002 | |

| The Cycles of Financial Scandal By Kevin Phillips, July 17, 2002, The New York Times http://www.nytimes.com/2002/07/17/opinion/17PHIL.html | |

| The Challenge of Central Banking in a Democratic Society Remarks by Chairman Alan Greenspan At the Annual Dinner and Francis Boyer Lecture of The American Enterprise Institute for Public Policy Research, Washington, D.C. December 5, 1996 http://www.federalreserve.gov/boarddocs/speeches/1996/19961205.htm | |

| Corruption in Corporate (North) America: the sky is truly falling, trust no one By Mario deSantis, July 12, 2002 | |

| ANALYSIS-Could dollar slide vs euro, yen turn to rout? By Sumeet Desai, July 16, 2002, Reuters News Service http://www.forbes.com/business/newswire/2002/07/16/rtr662715.html | |

| O'Neill backs strong dollar Treasury Secretary says euro has only regained half its original value in latest runup. CNN/Money, July 16, 2002 http://money.cnn.com/2002/07/16/news/economy/oneill.reut/index.htm | |

| Double Bubble: The Implications of the Over-Valuation of the Stock Market and the Dollar by Dean Baker, Center for Economic and Policy Research, June 2000 http://www.cepr.net/columns/baker/double_bubble.htm | |