|

|

|||||||

|

On the Myth of Economics’ Productivity Growth: |

|||||||

| Prince Albert - Monday - September 27, 2004 - by: Mario deSantis | |||||||

William E. Simon , former Treasury Secretary in the Nixon Administration[1] |

|||||||

Kevin Kelly, Co-founder of Wired Magazine[2] |

|||||||

| Rather than listening to the never ending litany of Exporting America by American patriot Lou Dobbs of CNN, we must appreciate the simple fact that the continuous cover up of a single endemic social and economic corruption leads to more and ‘catastrophic’ endemic social and economic corruption. | |||||||

| I am against Bush’s war in Iraq because it was simply a war of choice which has become Bush’s catastrophic success[3]. We must learn that when we experience public policies to satisfy the vested interest of the few and privileged rather than to satisfy the need of people at large, then we have the cumulative experience of a convoluted corrupted administration where one big lie covers a smaller lie, that is the Bush Administration. And it is amazing that Bush is perceived to be a stronger and steadfast leader, when in reality he is a flip flopper[4][5]. | |||||||

| Bush’s policies are steady, they are so steady to have a quagmire in Iraq only to cause more deaths[6], so steady to have military bases all over the world only to cause hate against America[7], so steady to have deeper tax cuts only to cause a bigger government in the future[8], so steady to have deeper budget deficits only to cover it up with his so called ownership society[9], so steady to have a high valued dollar only to have unsustainable trade deficits[10]... Yes, president Bush is steady in totally reforming America’s social contract into his privatised ownership society, but I find only one problem with him, he should reform himself[11]. | |||||||

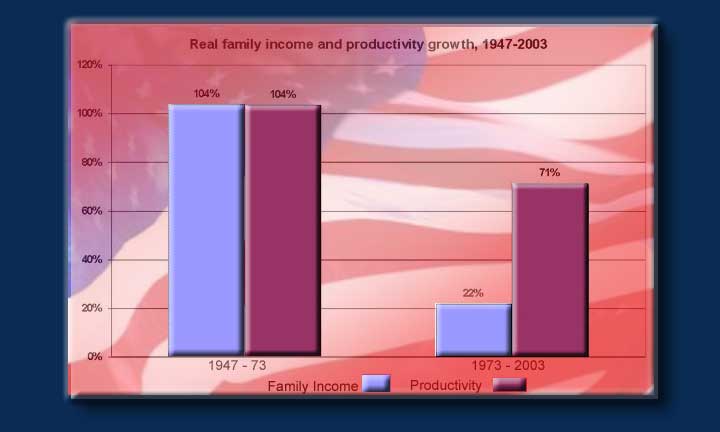

| Few days ago I wrote how Canadian journalist Jeffrey Simpson was misguided in understanding the notion that the so-called ‘productivity growth’ is the reason for the growth in our standard of living[12]. The United States experienced a growth in Gross Domestic Product (GDP) of 4.7% last year and yet at the same time American workers experienced a decrease in their standard of living[13]. | |||||||

| It is a fact that the United States is exporting jobs abroad to increase the productivity of the big multinational corporations. It is a matter of common understanding that multinational corporations want to take advantage of the low wages experienced in developing countries to increase their profits. But our world is not simple, and our perceived social and economic problems are all interrelated. And today, for example, I learn how the exporting of American jobs can be partially related to the setting up of foreign subsidiaries to avoid paying taxes in the United States. So we have the realisation of the spiraling concept of social and economic corruption. In this respect it is quite educational to read the following extract of a recent New York Times editorial: | |||||||

"A new study showing that American multinational companies booked a record $149 billion of profits in tax-haven countries in 2002 is further evidence, if any were needed, that the corporate tax structure is much in need of repair. |

|||||||

| References: | |||||||

| Pertinent articles published in Ensign | |||||||

| Simon, William E., MEDIA TRANSPARENCY http://www.mediatransparency.org/people/william_simon.htm |

|||||||

|

|

|||||||

| Kelly, Kevin, Spiegel Online

Interview May 22, 2003 http://www.kk.org/interviews/spiegeleng.php |

|||||||

|

|

|||||||

| Wright, Jim ‘Catastrophic success’? Don't laugh too

soon (pdf) September 10, 2004 Knight Ridder Newspapers http://www.fortwayne.com/mld/newssentinel/news/editorial/9628641.htm |

|||||||

|

|

|||||||

| American Progress Action President Bush: Flip-Flopper-In-Chief September 2,

2004 http://www.americanprogressaction.org/site/pp.asp?c=klLWJcP7H&b=118263 |

|||||||

| Welcome to Bush FlipFlops at Compassiongate! http://flipflops.compassiongate.com |

|||||||

| Hasan, Khalid US in a quagmire in Iraq (pdf) September 22,

2004 Daily Times http://www.dailytimes.com.pk/default.asp?page=story_21-9-2004_pg7_47 |

|||||||

| Johnson, Chalmers, Evolving

Empire:Chalmers Johnson on Bush's Major Troop Realignment August 17th, 2004,

DEMOCRACY NOW http://www.democracynow.org/article.pl?sid=04/08/17/1354236 |

|||||||

| Shaviro, Daniel How Tax Cuts Feed the Beast (pdf)

September 21, 2004 New York Times http://www.nytimes.com/2004/09/21/opinion/21shaviro.html |

|||||||

| Weisbrot, Mark The

Ownership Society: No Taxes for Owners, Only Workers Sept 19 Knight-Ridder/Tribune http://www.cepr.net/columns/weisbrot/ownership_society.htm |

|||||||

| Coy, Peter Getting Sucked Into the Trade Gap Aside from

causing the U.S. to pile up an unsustainable debt, the yawning deficit saps the country's

economic growth (pdf) September 14, 2004 Business Week http://www.businessweek.com/bwdaily/dnflash/sep2004/nf20040914_6465_db016.htm |

|||||||

| deSantis, Mario REFORM: another word for covering the assets of businesses, experts and politicians September 18, 2004 Ensign | |||||||

| deSantis, Mario Jeffrey Simpson preventative economic solution: more money into higher education rather than health September 13, 2004 Ensign | |||||||

|

|

|||||||

| Weisbrot, Mark Labor

Day 2004: Not Much To Celebrate September 3, 2004 CEPR http://www.cepr.net/columns/weisbrot/mark_weisbrot_9_03_04.htm |

|||||||

|

|

|||||||

| New York Times Taxing Global Profits Editorial, September 17, 2004 (This story

is no longer available free on line) http://www.nytimes.com/2004/09/17/opinion/17fri2.html |

|||||||

|

|

|||||||

|

|

|||||||