|

|

|||||||

|

Flat tax unfairly increases burden |

|||||||

| Waldeck - Tuesday, January 27, 2004 - by:Joyce Neufeld | |||||||

|

fair in |

Until about the year 2000, town, village and city councils calculated their tax collection rates based on the assessed value of the home. This was done by the formula assessed value x Mill Rate. To us, this was fair as everyone paid the same rate of taxation. | ||||||

|

|

|||||||

|

base |

Shortly after that, the Provincial Government brought in changes to the Urban Municipal Act which allowed a minimum tax. We assume this was done to encourage development of vacant properties etc.. and can understand this. Then in 2001 with pressure from some city/town councils, the Government again changed the act, this time allowing for a base tax. For those of you who do not know how this works, council establishes a base tax of $xx. The base tax is a flat tax that is applied on every property regardless of its value. | ||||||

|

|

|||||||

|

lower |

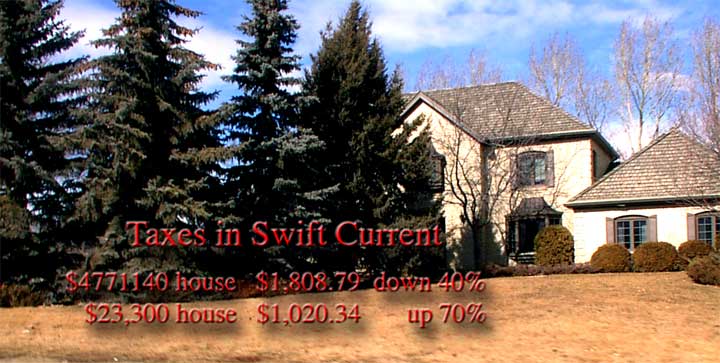

Council then adds on a mill rate on top of this. What this does, is it allows councils to lower the mill rate, but that only benefits the higher assessed properties. In the city of Swift Current, the highest assessed property has a assessed value of $477,140.00. Under the 2000 formula this property would have paid $3,311.47 in property tax. However, in 2003 that same property paid $1,808.79 - a decrease of over 40%. At the same time, a property assessed at $23,300.00 in 2000 went from $600.31 in 2000 to $1,020.34 in 2003 - a increase of 70%. | ||||||

|

|

|||||||

|

346% |

Meanwhile, in the small community of Waldeck, the second highest assessed home paid less property tax in 2003 than it did in 2000 despite inflation and a house that had one of the lowest assessed value in the same community saw an increase of 346% in their taxes in the same time frame. | ||||||

|

|

|||||||

|

repeal |

This is happening in communities all across Saskatchewan, and unfortunately, it is the seniors and the low income families who are suffering and who are subsidizing the wealthy home owner under a base tax system. We therefore ask that the Government of Saskatchewan repeal Section 279.5 of the Urban Municipal Act to eliminate the base tax and restore some fairness to our Municipal tax system. | ||||||

|

|

|||||||

|

write for |

Those of you who feel that the present base tax system is just another way of shifting the tax burden from the affluent onto those least able to pay are urged to e-mail or write the Premier <premier@gov.sk.ca> and Len Taylor, Minister of Intergovernmental Affairs <ministerGR@graa.gov.sk.ca) requesting complete elimination of Section 279.5 of the Urban Municipal Act. We also urge you to send a copy of your letter to the Saskatchewan Party <info@skcaucus.com> and the NDP at <caucus@ndpcaucus.sk.ca> with instructions to distribute to all Members of the Legislative Assembly. Please include your full mailing address or your concerns will not be taken seriously. | ||||||

|

Citizens for Fair Property Tax |

|||||||

|

Thomas Shelstad |

|||||||

|

Swift Current |

|||||||

|

|

|||||||

|

|

|||||||